Install Huzzler App

Install our app for a better experience and quick access to Huzzler.

AI powered Stock and Portfolio Anlaysis and Predictions platform.

Posts

Hello everyone! I'm excited to share a project I've been working on - an AI-driven investment platform called StockSageAI.

What I Built

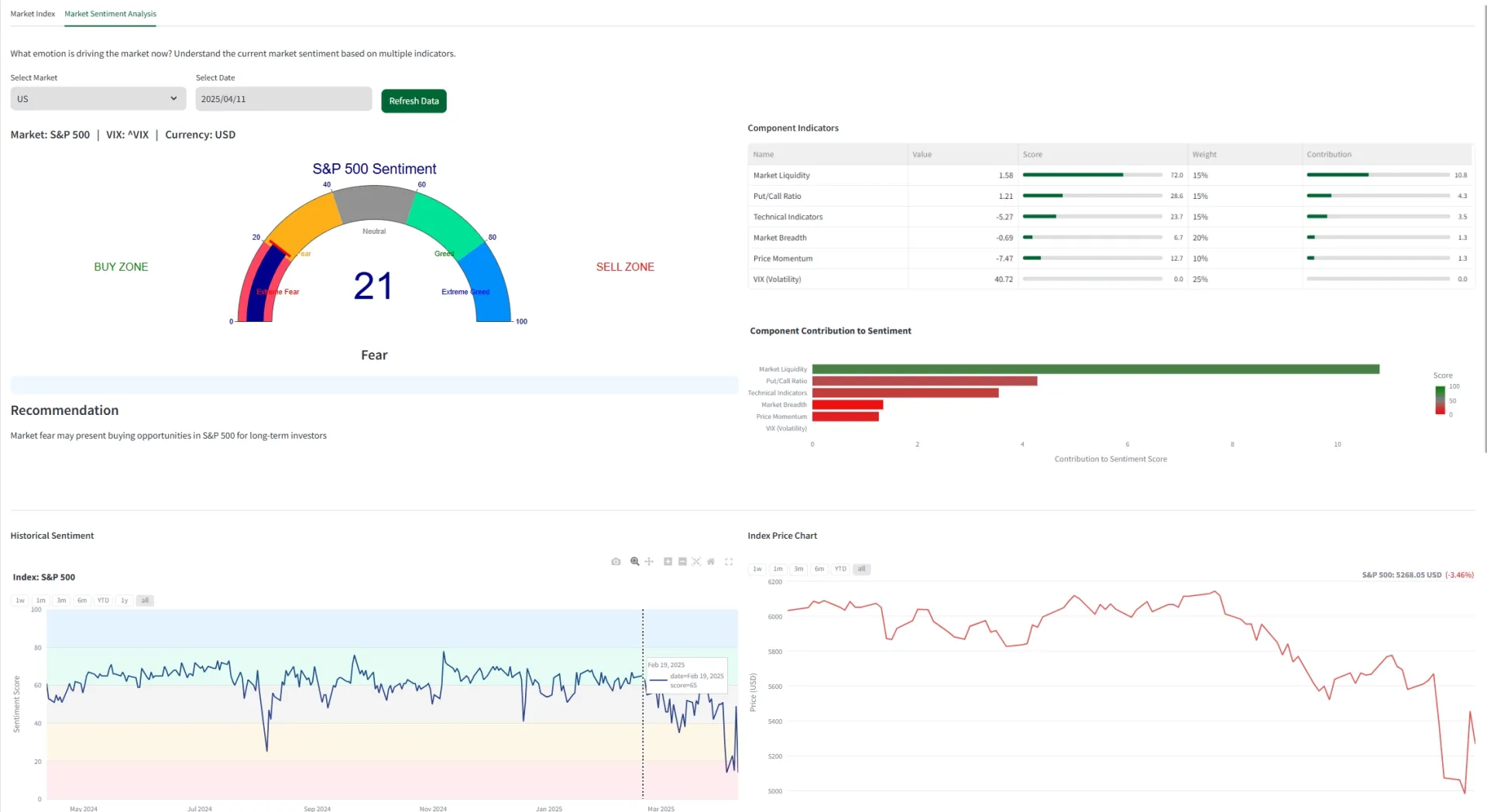

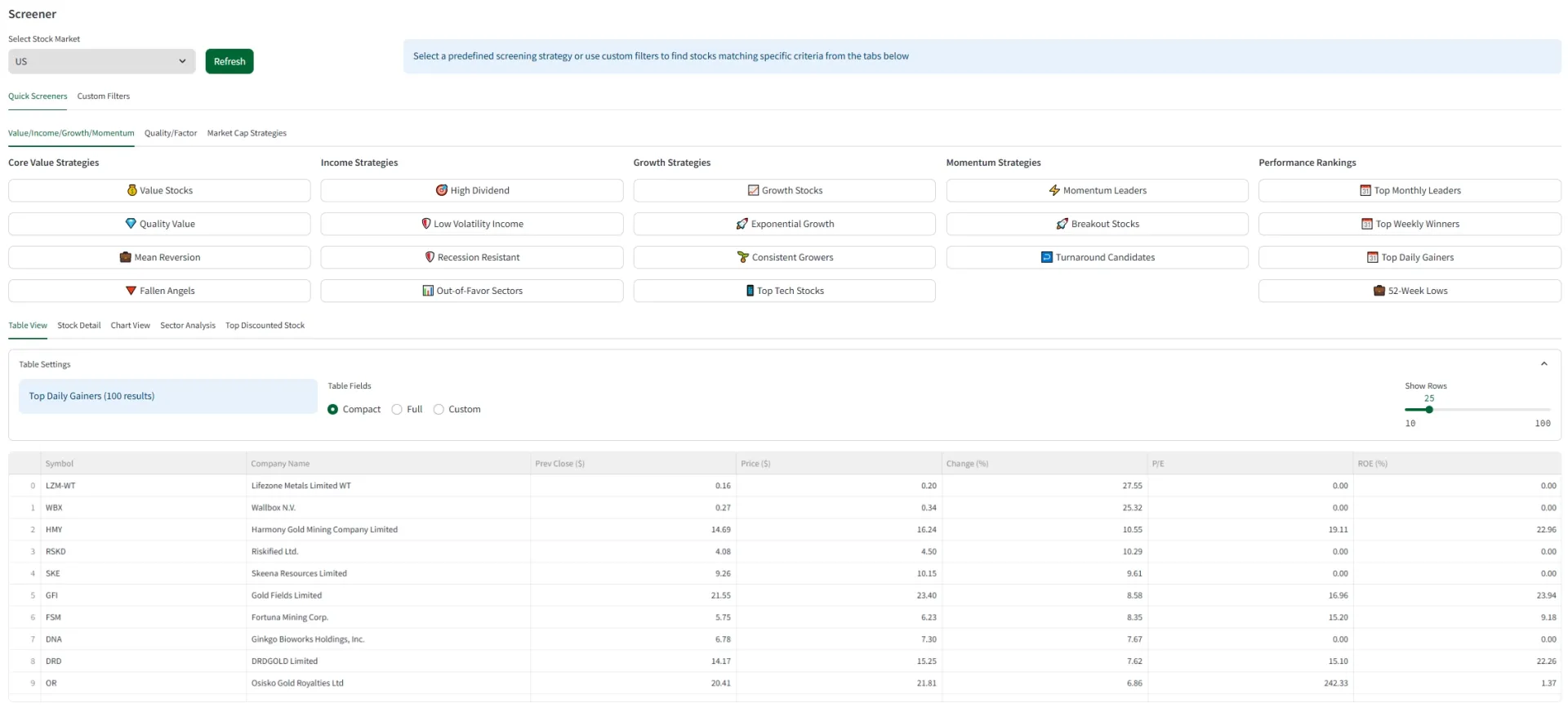

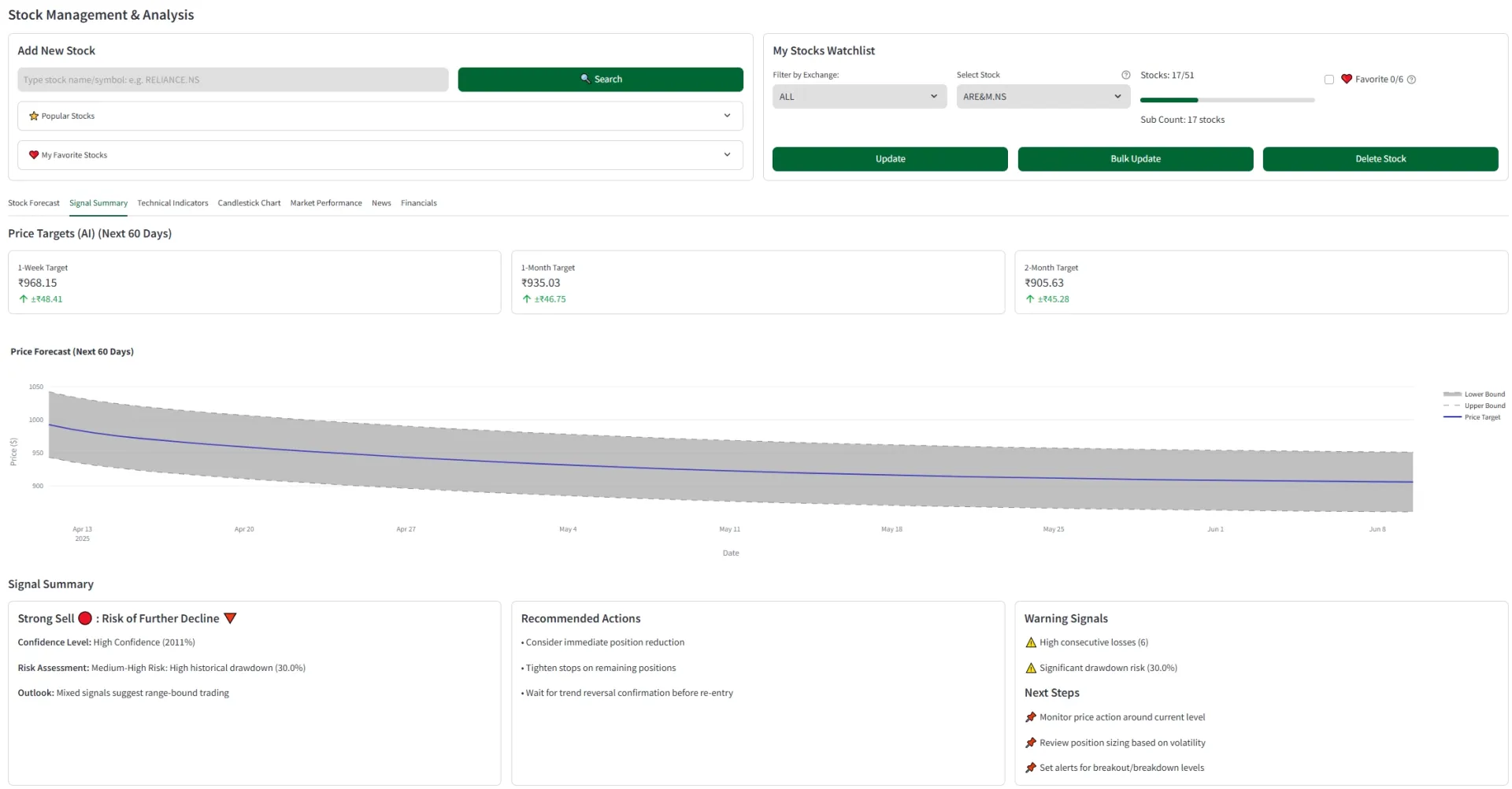

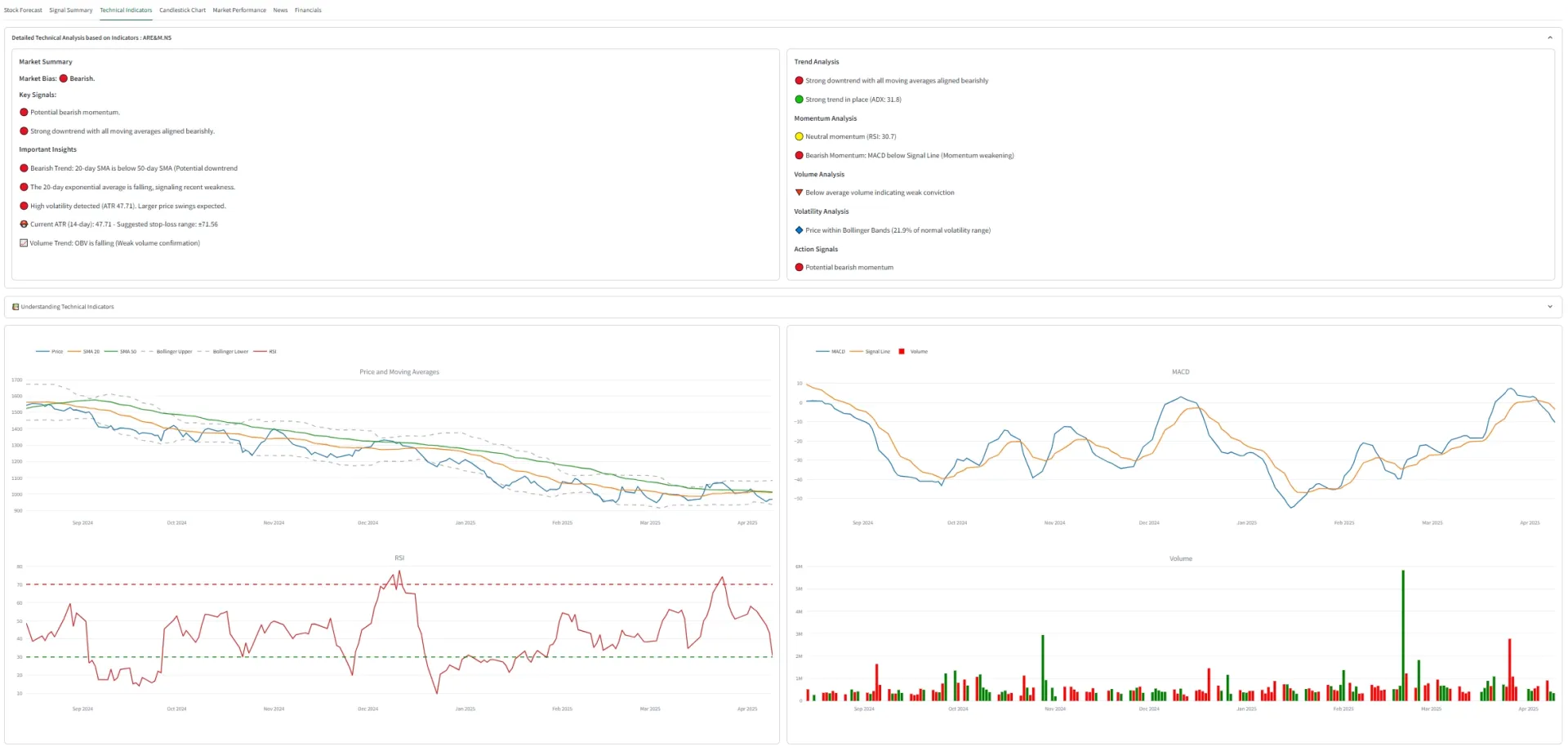

StockSageAI is a comprehensive platform that helps investors make smarter decisions through AI-powered analytics, screening, and portfolio management. It features:

- Market Indices: Tracks major market indices across US and Indian markets, providing real-time performance data, historical trends, and comparative analysis. Users can visualize index movements and correlations, helping them understand broader market conditions that influence their investment decisions.

- Stock Analysis and Prediction: Offers in-depth stock analysis with technical indicators, fundamental metrics, and price pattern recognition. The system provides peer comparison, relative performance analysis, and visualizes historical price movements to help identify trends. Our predictive models generate insights on potential future performance based on historical patterns and market conditions.

- Portfolio Management: Empowers users to track their investments in a unified dashboard with detailed metrics on performance, allocation, and returns. The platform supports transaction tracking, automatically calculates realized and unrealized gains, and provides sector-based diversification analysis. Users can simulate 'what-if' scenarios to see how portfolio changes might affect overall performance.

- Portfolio Health: Evaluates portfolio robustness through a comprehensive health scoring system that analyzes diversification, risk alignment, sector allocation, and performance metrics. The system generates actionable insights and highlights potential vulnerabilities, recommending specific adjustments to improve portfolio resilience and alignment with investment goals.

- AI Portfolio Advisor: Creates personalized investment portfolios based on user-defined parameters like risk profile, investment goals, and time horizon. The AI optimizes stock selection and weighting using sophisticated mathematical models, considers budget constraints to provide actionable investment plans, and rebalances recommendations over time as market conditions change.

- Research & Analysis: Provides a comprehensive research environment with sector analysis, undervalued stock identification, and emerging trend spotting. The platform aggregates and analyzes financial metrics across market segments, helping identify opportunities that match specific investment criteria. Custom screening capabilities allow users to build and save their own research parameters for ongoing monitoring.

- Advanced Stock Screener: Includes 20+ ready-to-use screening strategies covering value investing, growth stocks, dividend income, technical patterns, and more. Users can also create custom screens using natural language queries.

- Multi-Market Support: Full support for both US and Indian markets with appropriate currency handling and market-specific metrics.

How I Built It

Technology Stack

- Backend: Python with SQLAlchemy for ORM

- Frontend: Streamlit for the interactive web interface

- Data Processing: pandas, numpy, and scipy for financial calculations and optimization

- Visualization: Plotly for interactive charts and performance visualizations

- Market Data: Integration with financial APIs for real-time price data

Key Technical Challenges

- Portfolio Optimization Algorithm: I implemented a sophisticated portfolio optimization engine using mean-variance optimization with custom risk weighting and diversification constraints. This involved advanced mathematical modeling to balance expected returns against volatility.

- Natural Language Query Engine: Created a system that translates natural language queries like "P/E < 15 AND ROE > 15" into structured database queries, making stock screening more accessible.

- Efficient Backtesting: Developed a robust backtesting system that can analyze historical performance of portfolios against benchmark indices, all within a responsive web interface.

- Data Consistency: Built a resilient database layer with transaction management and proper error handling to ensure data integrity across concurrent user sessions.

- Market Analysis Integration: Implemented algorithms to identify correlations between market indices and individual stocks, helping users understand how broader market movements might affect their specific holdings.

- Predictive Modeling Pipeline: Designed a modular system that combines technical indicators, fundamental data, and market sentiment to generate stock performance predictions with confidence intervals.

Learning Journey

The most challenging aspect was implementing the portfolio optimization algorithm to handle varying investment amounts while maintaining target allocation weights. I spent significant time researching financial modeling techniques and refining the algorithm to ensure it produces realistic, implementable portfolios.

Working with financial data presented unique challenges around handling missing values, currency conversions, and addressing edge cases in market data. These experiences significantly improved my data engineering skills.

Building the portfolio health analysis system required significant research into risk metrics and diversification measurement techniques to create a scoring system that provides genuinely useful insights rather than just raw numbers.

Next Steps

I'm currently working on enhancing the platform with:

- Machine learning for anomaly detection in stock prices

- Additional portfolio optimization strategies

- Improved real-time notifications for price movements

- More sophisticated backtesting capabilities

- Integration with economic indicators for better macroeconomic context

- Enhanced natural language processing for more intuitive research queries

I'd love to hear any feedback or suggestions from the community, particularly around the portfolio optimization algorithm or ways to make the platform more intuitive for non-technical users!