TaxTools.ai is a free, comprehensive paycheck calculator providing accurate take-home pay estimates for all 50 US states with specialized support for complex local tax jurisdictions.

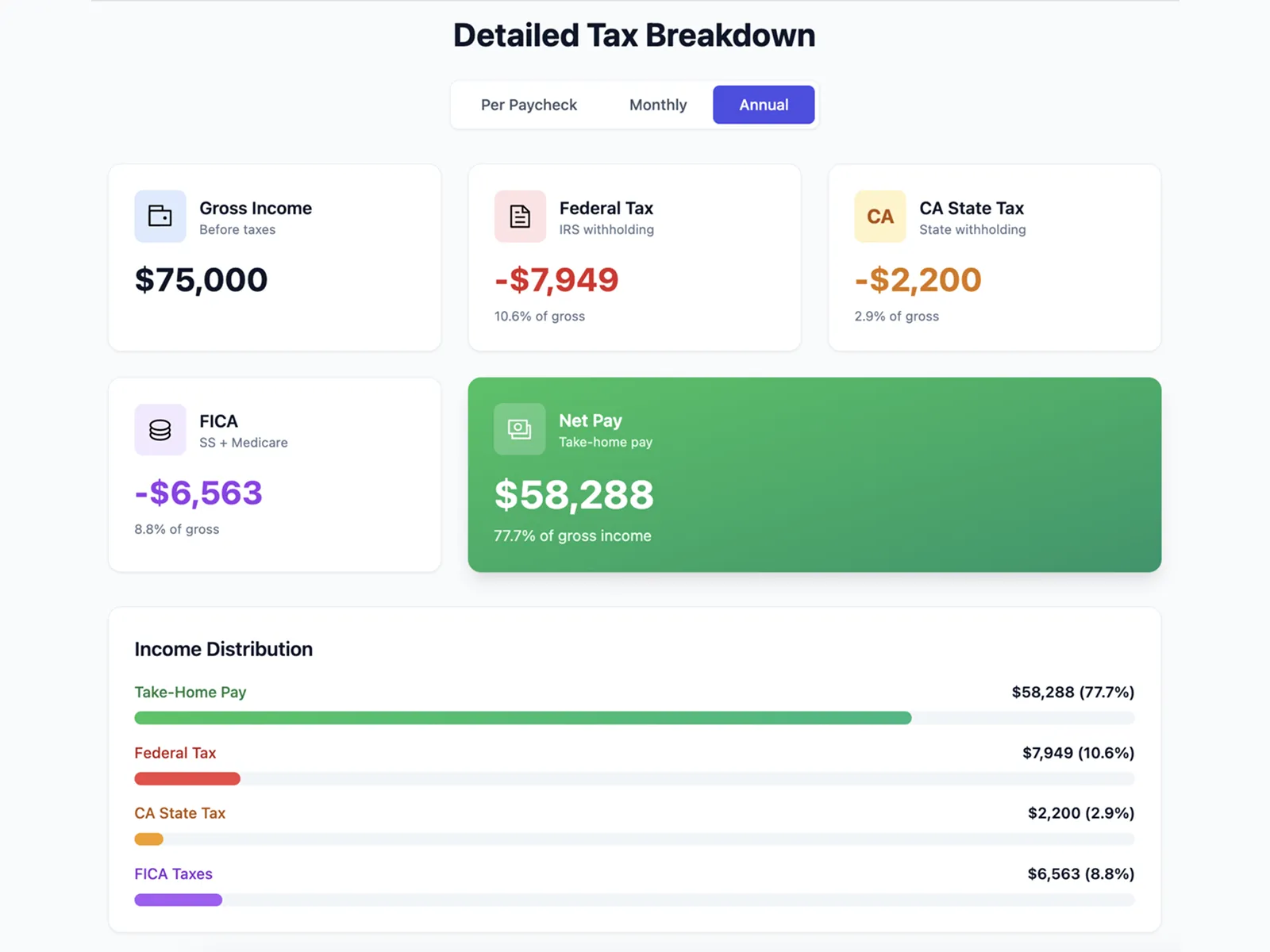

Our core functionality includes federal tax calculation using 2025 IRS brackets (10%-37%) with all filing statuses, state tax calculation for all 50 states including high-tax states like California (1%-13.3%) and New York (4%-10.9%), unique local tax support for NYC (2.907%-3.876%) and Yonkers (16.75% surcharge), FICA calculations (Social Security 6.2%, Medicare 1.45%), and advanced options for pre-tax deductions and multiple pay frequencies.

Practical applications include salary negotiation across different states (compare $120K in NYC vs $100K in Austin), budget planning with accurate monthly take-home forecasts, career relocation decisions understanding real cost-of-living differences, and freelance tax planning for quarterly obligations. We solve critical user needs including tax complexity confusion from multiple tax layers (federal, state, local), hidden costs of high salaries in expensive cities, paycheck verification to ensure correct withholding, location arbitrage for remote workers, and financial transparency without paying for professional advice on basic questions.

No comments yet. Be the first to comment!