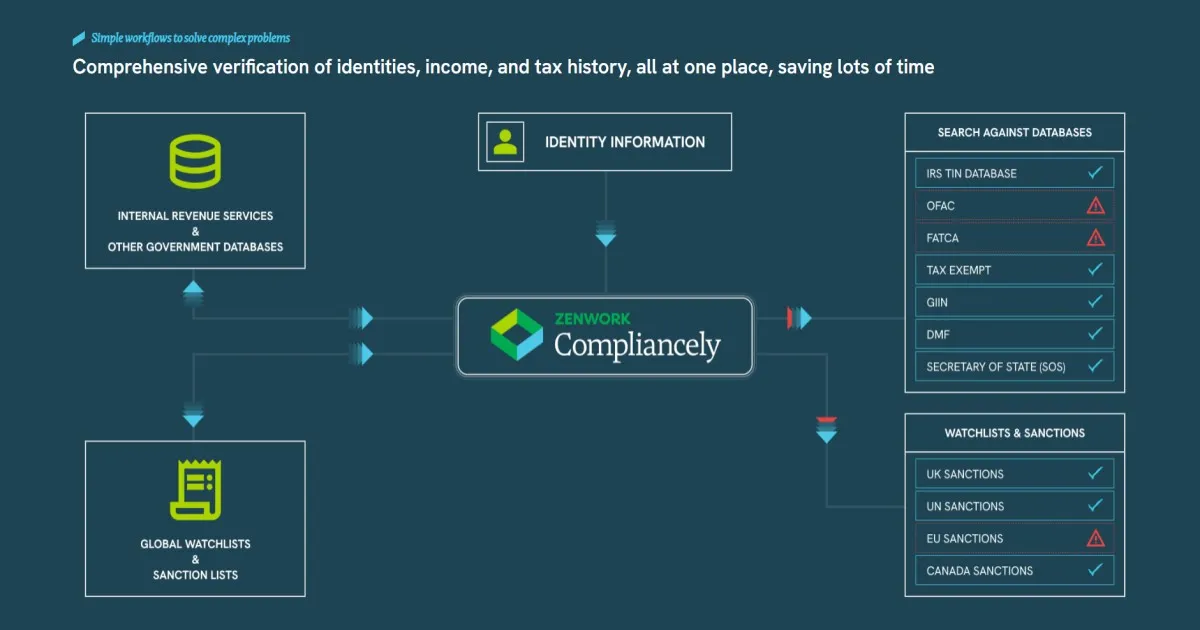

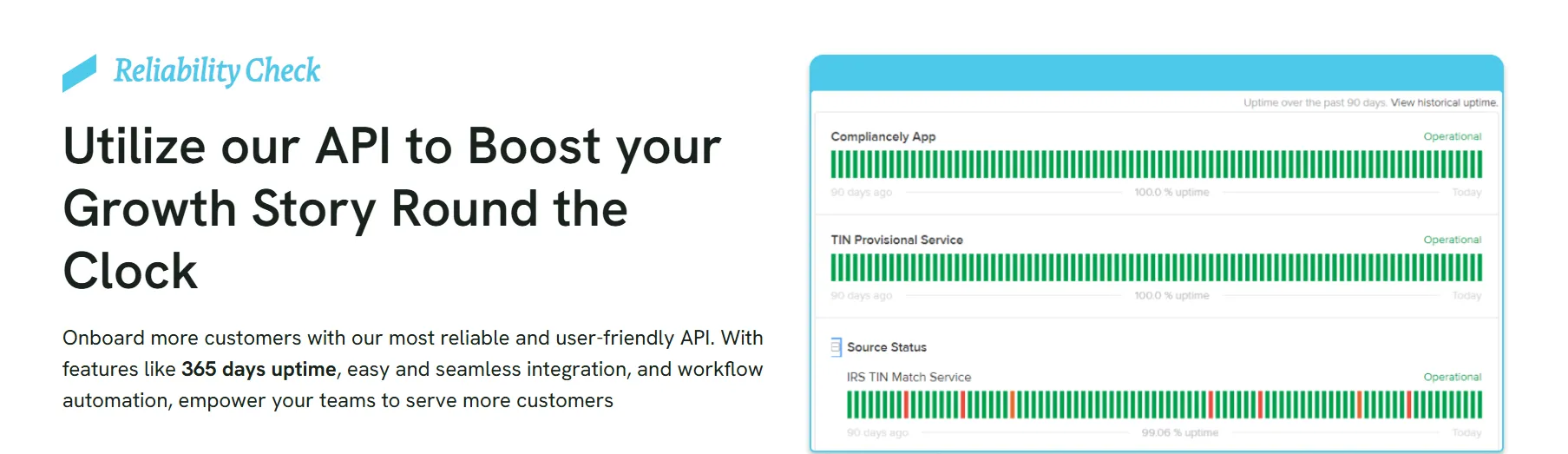

Compliancely provides real-time identity and compliance checks directly from authoritative sources, via REST APIs and a self-serve portal. Common checks include IRS TIN Matching, sanctions screening (OFAC/FATCA/DMF), Secretary of State entity lookups, GIIN/FATCA, Address verification, tax transcripts, and risk assessment reports. Results return in 1–3 seconds with 99.9% availability, backed by bulk APIs, webhooks, and asynchronous processing. No third-party data involved, always source-verified.

Why teams choose Compliancely: faster than the IRS interface (real-time vs. delayed), bulk API support, 24×7 support, and native integrations with 11+ accounting platforms.

Global KYB: verification in 42 countries (and expanding), all from the original registries and tax authorities.

Real Time TIN matching.

24*7 support.

AI Automation.

IRS/FinCEN compliant.

Login to post a comment.